Table of contents

April 2020 Update: The current compliance deadline for all medicines manufactured in Russia or imported into Russia is July 1, 2020. As of December 31, 2019, medicines that fall under the government’s HCN/7 Nosologies guidelines are expected to comply with the current serialization requirements, which comprise 4 elements: Product Code (GTIN), Serial Number, Crypto Key, and Crypto Code. Expiry Date and Batch Number are no longer required. See the latest Russia Regulatory Updates for news on Russia Track and Trace regulations.

The Russian regulation introduces one of the world’s most comprehensive—and complex—set of track and trace requirements. Even businesses who have implemented U.S. DSCSA and EU FMD solutions are struggling to understand, plan for, and implement the mandates introduced under Federal Law No. 425-FZ.

To get started, companies that sell product into Russia need to focus on six critical considerations, and understand how Russia challenges differ from those of FMD and DSCSA.

1. Phased and unconfirmed implementation timing

Current indications are that all medicinal products manufactured in or imported into Russia must be serialized and reported on after 31st December 2019. However, two categories of medicines may be subject to an even earlier deadline:

- VED (Vital and Essential Drugs) list: treatments for illnesses with a high prevalence in Russia, and whose cost is therefore controlled by the Russian Government to ensure access to treatment.

- 7HCN or Seven Nosologies: treatments for a class of seven fairly rare but expensive to treat medical conditions: hemophilia, cystic fibrosis, pituitary dwarfism, Gaucher disease, myeloid leukemia, multiple sclerosis and immunosuppressive therapy for organ transplant patients.

The deadlines for these two categories has not yet been published, but they are widely expected to be in force by the end of 2018.

2. Complex reporting and notification choreography

Products must be accounted for at every step of their journey, from manufacture to patient dispensation. An important difference between the Russian and the EU and U.S. regulations is the requirement to track a wide range of product movements and packaging changes between transfers of custody. In addition, these events must trigger both bi-directional notifications with trade partners and reports to the Russian central system, the Federal State Information System for Monitoring Drug Circulation (FSIS MDC).

Russia has indicated that foreign manufacturers will be responsible for reporting up to 36 events for product transactions and movements, including aggregation/disaggregation activities and managing upstream and downstream notifications between trade partners. For comparison, EU FMD has a total of 7 compliance events that must be tracked.

Reporting to the FSIS MDC needs to be carried out via XML uploads and must include electronic signatures—a potentially cumbersome process. In addition, the responsibility to report is time bound, so tasks must be completed quickly—indications are that the window will typically be 5 business days—and in the required sequence.

3. Different reporting requirements based on different business use cases

Russian reporting mandates vary based on business type and model. For example, whether the company manufactures products inside or outside of Russia—or both—and whether it partners with, or operates as, a CMO impacts the requirements. Without standardization, business logic and modeling will define the types and sequence of compliance events that must be tracked and reported.

4. Broad scope of covered products

While track-and-trace requirements in the EU and U.S. are generally limited to prescription (Rx) and high-value medicines, Russian regulations include both prescription and over-the-counter (OTC) products. This has implications for:

- Product master data: Pharma companies who have prepared for EU FMD or U.S. DSCSA will have already compiled or be in the process of compiling product master data for their Rx products (and certain exceptions, such as the EU FMD “black list” of OTC medicines that are in-scope). To comply with expected Russian regulations, master data will now need to be sourced for OTC products as well.

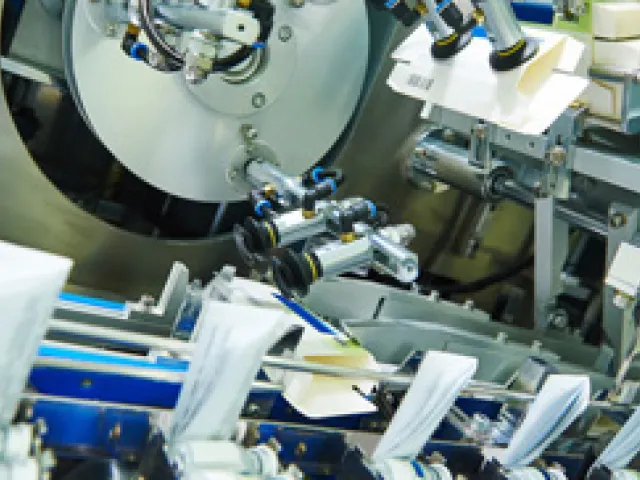

- Manufacturing lines: Pharma companies preparing for EU FMD and DSCSA may have only configured their Rx manufacturing lines for serialization. The inclusion of OTC products in the Russia requirements mean that companies will need to ensure that all lines manufacturing medicines for Russia are equipped for serialization by the Russian deadlines.

5. Aggregation requirements

Another key difference with Russia is that cases must display a serial number identifying its contents, which also bear unique identifiers. Any changes to packaging configurations during the product’s journey are considered compliance events. Aggregation and disaggregation activities such as “unit pack” and “unit unpack” must be documented and reported. While many companies doing business in the U.S. and EU have chosen to aggregate, neither FMD nor DSCSA include aggregation requirements.

6. Uncertainty around publication of final guidance

It is unclear exactly when the Russian government will provide definitive guidance on compliance requirements, technical requirements, the scope of medicines covered, and deadlines. The timing for publishing the final guidance is yet to be announced.

TraceLink: A proven solution provider for global compliance

In the absence of definitive guidance and a single, standard compliance process, TraceLink helps companies develop a Russian compliance strategy that relies on business logic and regulatory expertise to move quickly once the Russian guidelines—and deadlines—are finalized. TraceLink has the proven experience in developing Level 4 – 5 serialization solutions that meet the EU, U.S., Brazil, and South Korea regulations—and is a trusted partner of leading pharma companies doing business in Russia.